Tax Freedom Day, this year, will be on 23 May – two days later than last year. For taxpayers, this year is the worst ever, and the next two years are projected to be even worse. Tax Freedom Day is the day when we South Africans will have earned enough to pay all the taxes levied on us by national government for the year. In other words, if we were required to pay all our taxes up-front, we would have to pay government ALL the money we earn through 22 May, and, only after that date ie from 23 May, could we start to think of it as our own.

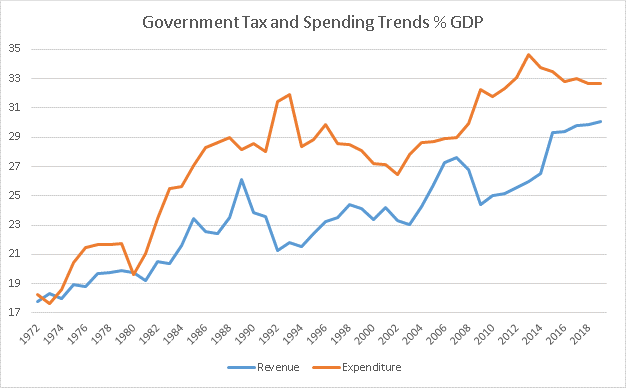

In the graph below, you can see tax revenues and government expenditures since 1972 expressed as a percentage of GDP. The graph reflects only central government revenue and expenditure. The last two points on each line are estimates. Since 1972, taxes have increased as a proportion of the economy by 67% and spending by 80%. Since 1994, the increases have been 38% and 16% respectively.

The tax revenue trend shows fairly minor variations around a straight line. The trend, since 1994, is for Tax Freedom Day to be 1.26 days later every year on average, or about 19 days every president and an extra month per generation. It takes 5 weeks longer to pay for government today than it did in 1994, and almost 2 months longer than in 1972! The spending trend is more variable but on average even more upward than the revenue trend.

One can see some interesting phenomena in the variations. Toward the end of NP rule, there was a big rise in government spending and a drop in revenue when the NP tried to appeal to new voters as they faced their first free election. In their first few years, the ANC government had to reduce spending and increase revenue to deal with the inherited Apartheid debt, but, eventually (and probably inevitably), spending increased sharply until the deficit became a problem. In 2008, the financial crisis caused a recession and lack of profits squeezed tax revenues but did not impede spending.

How bad is South Africa’s situation by international standards? There is plenty of evidence that, beyond the amount needed for keeping order, providing justice and solving coordination problems, increased government size tends to slow economic growth. For an economy the size of ours, government is larger than necessary. The vast amount of revenue spent on government consumption alone is especially bad for growth. We are, in effect, eating our seed stocks rather than planting them. Last year saw shrinking rate of investment.

By international standards, South Africa has a large number of government enterprises, many of which do things private enterprise can do better, and too many that are large loss makers regularly subsidised with tax revenue.

Why is the trend toward larger government bad? Obviously, if a government is already too big for optimum growth, getting even bigger will only make things worse. There is, however, evidence that change has a short term effect on growth besides the intended end result. For example, if the intended result is higher levels of economic freedom which are associated with higher growth rates, moving to that higher economic freedom level will boost growth rates further for about 5 years. Unfortunately, the opposite holds true for change that reduces economic freedom. South Africa’s economic freedom index has been declining parallel to its growing government. As long as this trend continues, we can expect to suffer from the extra dampening effect it will have on our economic growth.

The bad and worsening tax levels reduce how much you, personally, benefit from your work. Already, only about 60% of your labour goes toward your own welfare. Every year, you lose another day or two, and, for every generation, an entire month is lost. In 1972, for every Rand given the government, you got to keep R3.33. Now you get to keep R1.58 – less than half.

Having access to a larger share of the economy means government must be getting stronger. A country needs a government strong enough to avoid developing a failed state, but, beyond that necessary strength, the need for government to draw on available revenue and the ease with which is does so, becomes a threat to liberty. Various checks and balances serve to control that threat but increased power makes the task more difficult – especially if there are shifts in the size and strength of some branches of the state relative to others.

Finally, having more of a competent and honest government is one thing, but to have more of an incompetent and dishonest government, is quite another. And, let us face it, our government has had to deal with corruption at every level and in every department. Given, too, the poor performance of various departments, e.g. water management, education, infrastructure, policing, etc, our government appears incompetent. As taxpayers, do we really want to use the little economy we have left to feed this monster indefinitely?

Author Garth Zietsman, statistician. This article may be republished without prior consent but with acknowledgement to the author. The views expressed in the article are the author’s and are not necessarily shared by the members of the Foundation.